Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. He said the incentive was introduced from the onset of the HOC that began in 2019 to 2021 and which is still being continued for the purchase of first homes worth up to RM500000 until December 31 2025.

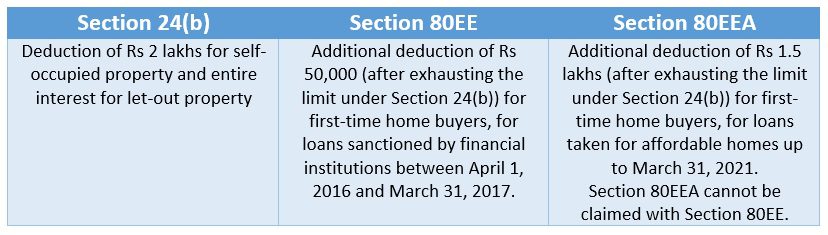

80eea Deduction Eligibility Rebate Applicability Period Total Benefit

2019 to 2020 2020 to 2021 2021 to 2022 2022 to 2023-125-560-585-610.

. You will pay stamp duty when the registration is transferred into your name. You must also pay transfer duty when you acquire land or an interest in land. Every person acquiring land or an interest in a landholder must complete the relevant declaration.

Alternative minimum tax AMT exemption amount increased. Stamp duty on a 500000 house in WA is 17765 for a non-first home buyer buying an established property new home or vacant land as. Property including your home or holiday home.

Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State. Australias Capital Territory has announced this week that new and used electric motorcycles are now exempt from stamp duty. This calculator works out the land transfer duty often referred to as stamp duty which applies when you buy a home by yourself or with another person and claim the pensioner duty exemption or concession.

Commercial or industrial properties or. If you served in a combat zone or qualified hazardous duty area you may be eligible for a longer. The stamp duty is to be made by the purchaser or buyer and not the seller.

Home buyer concession scheme from 1 July 2019 Who is eligible. Industrial or extractive industry use under a contract entered into on or after 1 July 2019. Stamp duty exemptionconcessions ACT.

The address to send payments by cheque has been added to the Ways to pay section. A business which includes land. See below for exemption for permanent residents 309 visa 820 visa 444 visa 405 visa and 410 visa holders.

When and how do I pay stamp duty. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount. Stamp duty is a tax that is levied on single property purchases or documents including historically the majority of legal documents such as cheques receipts military commissions marriage licences and land transactionsA physical revenue stamp had to be attached to or impressed upon the document to show that stamp duty had been paid before the document.

The big and beautiful US-Mexico border wall that became a key campaign issue for Donald Trump is getting a makeover thanks to the Biden administration but a critic of the current president says dirty politics is behind the decision. Purchase PriceValue Stamp Duty Transfer Duty Rate. Declaration before you register your transfer you can submit a late claim using the Application for concession exemption or correction of duty after registration of title form.

In Noida registration fee is 1 percent of the property value. As per the Indian Penal Code not paying the required stamp duty is a criminal offence. Stamp duty exemption on Perlindungan Tenang insurance policies and takaful certificates with a yearly premium contribution not exceeding RM100 for policies certificates issued from 1 January 2019 to 31 December 2025 RM150 for policies or certificates issued from 1 January 2022 to 31 December 2025.

A full stamp duty exemption is given on. 57300 if married filing separately. The AMT exemption amount is increased to 73600 114600 if married filing jointly or qualifying widower.

The vehicle stamp duty rates can be found on our rates page. Prior year 2019 earned income. A pre-construction contract between 23 October 2019 and 23 October 2021 inclusive to purchase a new residential unit or apartment or.

Jalan Tebet Timur Dalam X no2 Kel. February 2019 Related Guides. You must pay transfer duty once known as stamp duty in NSW when you buy.

From 22 November 2017 first time buyers paying 300000 or less for a residential property will pay no Stamp Duty Land Tax. Documents that require stamp duty. If you are a foreign person who signed a contract to purchase property before 1 January 2019 but the property settles after that date you wont be liable for the additional duty if the names of the transferees on the transfer are the same as the names of.

The stamp duty in Noida 2019 is levied on all categories of buyers including males females and joint property owners male and female. This must be done within 14 days from the date you bought the vehicle. Stamp Duty Exemption on Delivery of Hong Kong Stocks as Consideration for the Allotment or Redemption of a Share or Unit of an Authorized Open-ended Collective Investment Scheme.

Politics-Govt Just in time for US. Such delays in payment can make the individual liable to pay a hefty fine ranging from 2 to 200 of the total payable amount. 2 July 2019.

This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. Aside from an exemption for qualifying intermediaries such as market makers at large banks Stamp Duty Reserve Tax SDRT was introduced under the Finance Act 1986 to ensure that a form of tax equivalent to stamp duty would continue to be payable on the transfer of uncertificated shares. When we receive your claim we.

At that time it was expected that the TAURUS share trading system would come into. From 1 July 2019 the additional duty rate is 8 per cent. The ACT has made a number of strides to accelerate EV adoption including waiving stamp duty on EVs two years free registration and for eligible households access up to 15000 towards the cost of an EV under the.

021 83702848 Phone 2. Any relief or exemption or both claimed. Unless stated you must apply for an exemption from transfer duty.

Vacant land or a farming property. The stamp duty is to be made by the purchaser or buyer and not the seller Ask Free Legal advice. 20 or 120 per 100 or part thereof whichever is greater.

Other guides you might. Use our calculators to find out how much stamp duty you will need to pay. A 8 stamp duty surcharge and a 2 land tax surcharge applies to property purchased in New South Wales.

Eligible pension cardholders can claim a once-only exemption or concession from duty when they buy a property they intend to use as their principal place of residence. See how much Stamp Duty Land Tax SDLT you will pay in 2022 on your new property with our stamp duty calculator. To be eligible for the HBCS the following criteria must be met.

Senate race border wall gets a makeover. Ireland youll pay the same stamp duty rates as if you were buying in England including the first-time buyer exemption on the first 300000 of the property value. Stamp Duty Reserve Tax.

Family farms an exemption for the transfer of the family farm. Hello Amit Uttar Pradesh government has granted an exemption to individuals from a disabled category from payment of stamp duty for the. Tebet Jakarta Selatan 12820.

He said a stamp duty exemption incentive of 50 per cent meanwhile will be given for homes priced above RM500000 to RM1 million. Whichever way you obtain your property you must pay land transfer duty previously known as stamp duty on the transfer of the land from one individual to another. Application for Exemption of Stamp Duty under Section 29C5A of the Stamp Duty Ordinance CAP.

ACT stamp duty general rate from 1 July 2019.

Maharashtra Package Scheme Of Incentives 2019 A N Gawade Co

The 2019 Stamp Duty Exemption Property Insight Malaysia Facebook

Tm219610 3 F1 None 37 5158499s

Suresh Nakhua स र श न ख आ Twitterren Indie Electric Ppe Have Been Despatched To Cooper Hospital By Manmundra Https T Co 6ztebmbrnc Twitter

What Stamp Duty Exemptions Can I Get In My State Or Territory Savings Com Au

Superlink Homes Sungai Buloh Enjoy Special Discounts Stamp Duty Exemptions More When You Purchase A Gamuda Gardens Home 𝑮𝒓𝒂𝒃 𝒊𝒕 𝒏𝒐𝒘 By Gamuda Land Facebook

Maharashtra Package Scheme Of Incentives 2019 A N Gawade Co

Maharashtra Package Scheme Of Incentives 2019 A N Gawade Co

Pros And Cons Of Buying An Auctioned Property In India Tata Capital Blog

Maharashtra Package Scheme Of Incentives 2019 A N Gawade Co